No matter how experienced an investor you are, drawdowns are inevitable. Even the most successful investors have had to deal with them at some point or another. A drawdown is defined as a peak-to-trough decline during a specific period for an investment, fund, or commodity. In other words, it’s the difference between the highest high and the lowest low within that timeframe. Drawdowns are often measured in terms of percentage, with the depth of the drawdown being equal to the percentage drop from the peak to the trough. For example, if an investment had a value of $100 at its peak and then fell to $90, that would be considered a 10% drawdown. While drawdowns are a normal part of investing, they can still be difficult to stomach – especially if you’re not prepared for them. That’s why it’s important to know how to overcome a drawdown. In this blog post, we will explore some tips on how to overcome a drawdown so that you can keep your cool when the market takes a dip.

Defining a drawdown

A drawdown is typically defined as the peak-to-trough decline during a specific period for an investment, fund, or commodity.

For example, if an investment has a value of $100 at its peak and falls to a value of $90, the resulting drawdown would be 10%. The duration of the drawdown would be the time it takes for the investment to recover its previous peak value.

There are different types of drawdowns that investors should be aware of, including:

–Absolute Drawdown: This is the percentage change from an investment’s highest point to its lowest point.

–Drawdown Duration: This is the length of time that it takes for an investment to recover from a loss.

–Maximal Drawdown: This is the largest percentage drop from an investment’s peak value to its trough value.

–Relative Drawdown: This is the percentage change from an investment’s highest point to its lowest point, relative to another investment.

Each type of drawdown can give investors different insights into their investments. For example, an absolute drawdown can show how much an investment has lost in value, while a maximal drawdown can show how severe a loss was. Drawdown duration can also be helpful in showing how long it took for an investment to recover after a loss.

Why you should overcome a drawdown

When you’re in a drawdown, it can feel like the end of the world. Your account balance is shrinking, and your self-confidence is shot. But it’s important to remember that a drawdown is just a normal part of trading – it’s not the end of the road.

There are a few things you can do to help you overcome a drawdown:

1. Keep a trading journal

A trading journal can help you keep track of your progress and performance, which can be helpful when you’re feeling down about your results. It can also help you identify any areas where you need to improve.

2. Stick to your system

If you have a trading system or strategy that has been successful in the past, stick to it during a drawdown. Don’t let emotions get in the way of your decision-making.

3. Review your trades

Take some time to review your past trades, both good and bad. What worked well? What could you have done better? This analysis can help you avoid making the same mistakes in future.

4. Stay positive!

What To Do First?

If you’re experiencing a drawdown, the first thing you should do is take a step back and assess the situation. What caused the drawdown? Is it something you can control, or is it out of your hands?

Once you’ve identified the cause, you can start to take action. If it’s something within your control, like poor trading decisions, then you can work on improving your strategy. If it’s something out of your control, like unexpected market volatility, then you’ll need to be patient and ride out the storm.

Whatever the cause, remember that a drawdown is not the end of the world. It’s just a temporary setback. With some time and effort, you can overcome it and get back on track to achieving your financial goals.

Awareness is key.

In order to overcome a drawdown, it is important to be aware of what is happening with your investment. This means monitoring your account regularly and understanding what is driving the market.

If you are not aware of what is happening, you will not be able to make informed decisions about your investment. This can lead to making decisions that exacerbate the situation and cause further losses.

Awareness also allows you to take advantage of opportunities as they arise. If you are aware of the market conditions, you may be able to buy assets at a discount or sell assets for a profit.

Thus, awareness is key to overcoming a drawdown. By being aware of what is happening with your investment and the market, you will be better equipped to make decisions that can help you overcome a loss and achieve success.

Understand how probabilities work

A drawdown is a period of time during which an investment declines in value. Many investors experience drawdowns at some point in their investing careers, but it can be difficult to overcome them.

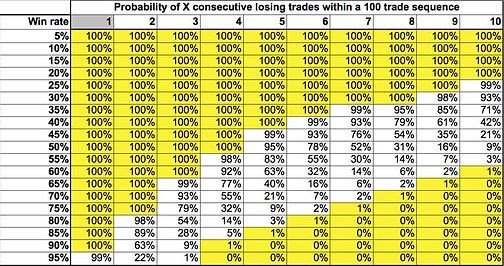

One way to overcome a drawdown is to understand how probabilities work. Probabilities can be thought of as the likelihood that something will happen. For example, the probability of flipping a coin and landing on heads is 50%. This means that if you flip the coin 100 times, you would expect it to land on heads 50 times.

However, just because the probability of something happening is 50%, doesn’t mean that it will happen exactly 50% of the time. There is always a chance that the coin will land on tails 100 times in a row. This is why we use statistics to help us understand probabilities.

Statistics can help us better understand probabilities and make more informed decisions when investing. For example, let’s say we are considering an investment that has a 70% chance of success. This means that there is a 30% chance of failure. We can use statistical tools to help us calculate the expected return of this investment, as well as the risk (i.e., the probability of failure).

Once we have this information, we can decide if the expected return is worth the risk. If not, we can look for other investments with better odds of success. By understanding how probabilities work, we can make more informed decisions about our investments

Tips To Help With Drawdowns?

When you are in a drawdown, the most important thing to remember is that you are not alone. Here are some tips to help you overcome a drawdown:

1. Stay positive and focused on your goals.

2. One strategy you can use in order to increase your win rate is to make shorter targets. This will help give you a better chance of winning while also raising your confidence or in other words, Shorter Targets help you with increased win rates and increased confidence.

3. Keep a written record of your trades so you can review them later and learn from your mistakes.

4. Find a trading mentor or coach who can help you stay disciplined and motivated during tough times.

5. Join or participate in an online community of traders who can offer support and advice.

6. Take some time off from trading if you need to clear your head and refocus on your goals.

When to get help

There is no set answer for when to get help during a drawdown, as it will vary depending on the individual and the situation. However, there are some general guidelines that can be followed. If the drawdown is causing significant financial hardship or impacting one’s quality of life, then it may be time to seek professional help. Additionally, if the drawdown is lasting longer than a few months or appears to be getting worse, it may also be time to seek assistance. Ultimately, if the drawdown is proving to be too much for an individual to handle on their own, then it is probably time to seek help from a professional.

Conclusion

There is no one-size-fits-all solution to overcoming a drawdown, as the approach that works best for you will depend on your individual circumstances. However, there are some general steps that you can take to increase your chances of success. Firstly, make sure that you have a clear plan in place and stick to it. Secondly, don’t be afraid to seek help from professionals if you need it. Finally, remember that even the most successful traders go through periods of losses – so don’t let a drawdown get you down.