Introduction to debt mutual funds

If you are looking to invest in debt mutual funds, it is important to understand what they are and how they work. Debt mutual funds are a type of investment that allows you to pool your money with other investors to buy bonds or other debt securities. These funds can offer you a higher return than traditional savings accounts or money market funds, but they also come with more risk.

Before investing in any type of mutual fund, it is important to do your research and understand the risks involved. With debt mutual funds, you are taking on the risk that the bonds or other securities in the fund may not be repaid. If interest rates rise, the value of your investment may go down. This is why it is important to consider your investment goals and risk tolerance when deciding whether or not to invest in these types of funds.

If you are looking for a way to potentially earn a higher return on your investment, debt mutual funds may be a good option for you. However, it is important to remember that these types of investments come with more risk than some other options. Be sure to do your research and understand all the risks involved before investing in any type of mutual fund.

Why debt funds are a good investment option?

Debt funds are a good investment option for a number of reasons.

First, they offer the potential for higher returns than other fixed-income investments such as bonds.

Second, they tend to be less volatile than equity investments, meaning they may provide stability in a portfolio during periods of market turmoil.

Finally, debt funds offer diversification benefits since they typically have little correlation with stock markets.

When is the best time to invest in debt funds?

Debt funds are a type of mutual fund that invests in fixed-income securities, such as bonds and treasury bills. These funds are less volatile than stock funds, making them a good choice for investors who are looking for stability and income.

The best time to invest in debt funds is when interest rates are low. This is because when interest rates rise, the value of bond prices falls, and vice versa. By investing when rates are low, you can lock in a higher yield.

Of course, there is no guaranteed time to invest in debt funds, and timing the market is always risky. However, if you’re looking for a safe investment with relatively high returns, debt funds may be the right choice for you.

What are the different types of debt funds?

Debt funds are broadly classified into 3 types

Short-term – Short-term debt funds have a portfolio comprising of instruments with maturities of up to 1 year. They are also known as money markets or liquid funds.

Medium-term – Medium-term debt funds have a portfolio comprising of instruments with maturities of between 1-3 years.

Long-term – Long-term debt funds have a portfolio comprising instruments with maturities of more than 3 years.

Performance Of Debt Funds Amid Rate Cut Cycle

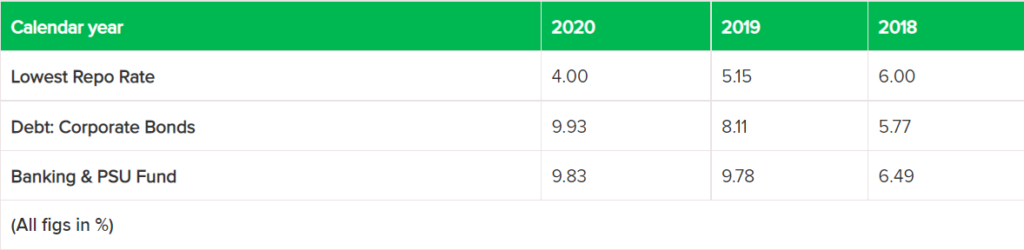

Debt funds are one of the most popular investment options in India. They offer investors an opportunity to earn high returns with low risk. However, debt funds are also subject to interest rate risk.

When interest rates fall, the prices of debt securities rise and vice versa. This means that investors in debt funds may see their fund values fluctuate in response to changes in interest rates.

However, over the long term, debt funds have proven to be resilient investments. Even during periods of falling interest rates, most debt funds have managed to generate positive returns for investors.

So, if you’re looking for a safe and stable investment option that can provide you with good returns, investing in debt mutual funds is a good option for you.

Strategy To Select Suitable Debt Fund Categories

Debt funds are categorized into different types based on the underlying securities. The four main categories are:

1. Government Securities Funds: These funds invest in government bonds and other debt instruments issued by central and state governments. They are considered to be the safest category of debt funds as they have very low default risk.

2. Corporate Bonds Funds: These funds invest in corporate bonds issued by companies. They offer higher returns than government securities funds but have slightly higher risk as there is a possibility of corporate defaults.

3. Credit Risk Funds: These funds invest in debt instruments of lower-rated companies which offer higher interest rates but have a higher probability of defaults.

4. Floating Rate Funds: These funds invest in debt instruments with floating interest rates. They are less affected by changes in interest rates as compared to other categories of debt funds.

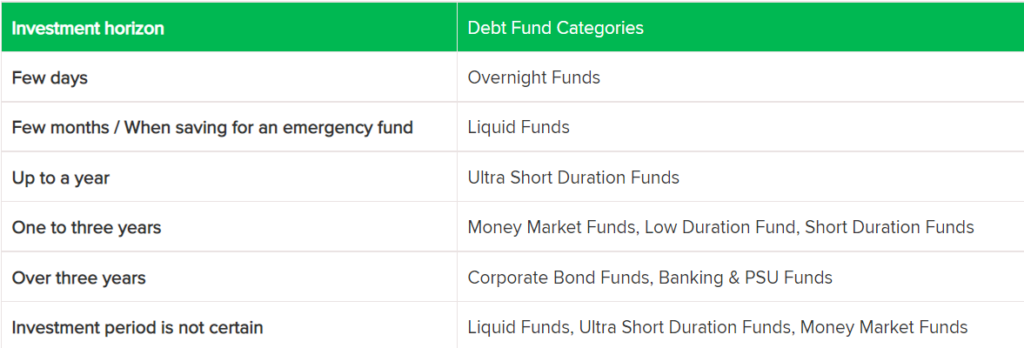

The best time to invest in a debt fund depends upon the investment objective and the time horizon of the investor. For example, if an investor wants to park his money for the short term then he can consider investing in a liquid fund or an ultra-short-term fund. On the other hand, if an investor is looking for capital appreciation then he can consider investing in the long-term gilt fund or dynamic bond fun

Read : How to build lasting wealth in the markets in 4 easy steps ?

Strategy To Select Suitable Debt Fund Categories

Debt funds are a type of mutual fund that invests in fixed-income securities, such as bonds and Treasury bills. While there is no one “best” time to invest in debt funds, there are certain strategies that can help you select the right type of debt fund for your needs.

The first step is to assess your investment goals. Are you looking for income or capital appreciation? If you need income, then you will want to focus on funds that offer regular payouts, such as monthly or quarterly distributions. These types of funds typically invest in shorter-term securities, so they may not be ideal if you are looking for long-term growth.

If capital appreciation is your goal, then you will want to look for funds that invest in longer-term securities. These types of debt funds may not offer regular payouts, but they can provide significant growth potential over time.

Once you have determined your investment goals, you can start to narrow down the field by assessing your risk tolerance. Debt funds come with different levels of risk, from low-risk products that invest in government bonds to high-risk products that invest in junk bonds. If you are willing to take on more risk, then you may be able to achieve higher returns. However, it is important to remember that high-risk investments also come with the potential for higher losses.

Once you have a good understanding of your investment goals and risk tolerance, you can begin to research specific

Risks associated with debt funds

There are several risks associated with debt funds, which include interest rate risk, credit risk, and liquidity risk.

Interest Rate Risk: This is the risk that changes in interest rates will affect the value of your investment. When interest rates rise, the value of your debt fund investment will usually fall, and vice versa.

Credit Risk: This is the risk that a borrower will default on their loan payments, which could lead to losses for investors in the debt fund.

Liquidity Risk: This is the risk that you may not be able to sell your investment quickly enough if you need to access cash in a hurry.

Conclusion

There is no one-size-fits-all answer to the question of when the best time to invest in debt funds is. However, there are a few things that you can keep in mind that may help you make a decision. First, consider your financial goals and what you hope to achieve by investing in debt funds. Second, think about your risk tolerance and how much volatility you are comfortable with. Finally, take a look at the current interest rate environment and decide whether now is a good time for you to start investing in debt funds.