To gain a better understanding of mutual funds, you should begin with a guide that will help you understand what mutual funds are, how they work, and the types of mutual fund investments available. This article will answer all your questions about investing in mutual funds in 2022!

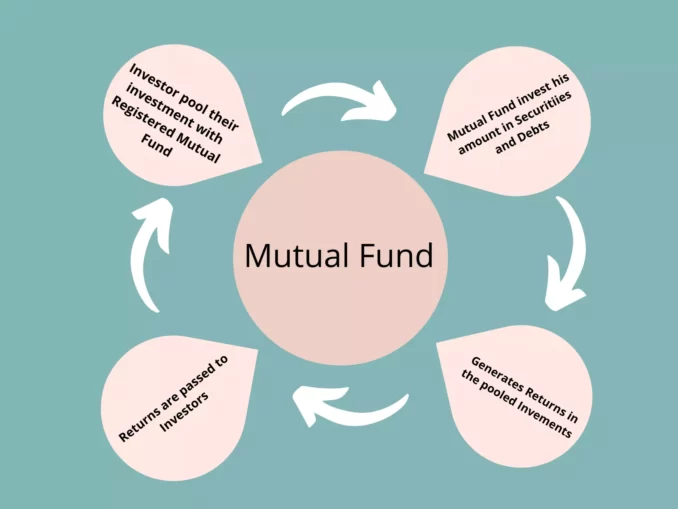

How do Mutual Funds work

Mutual funds are investment vehicles that all regular investors can take part in. They are like a mutual organization that anyone can put money into and anyone can withdraw their money from. Mutual funds distribute the money you put into other investments so that everyone has a chance to make money. They are constantly buying different investments as well as selling them off at a profit and reinvesting the cashback into more stocks, bonds, or properties whatever the fund does best.

Why should you invest in Mutual Funds

It is an essential part of the financial world to invest in mutual funds. Investing in mutual funds allows you to diversify your portfolio, which can reduce your overall risk of investing. Mutual Funds are also a way to make passive investments, meaning they don’t require as much effort as other investments. Mutual funds also offer a better return on your investment than regular investments.

Tax-saving

Tax-saving is one of the best benefits of investing in Mutual Funds. You can save a fairly significant amount of money on your taxes when you invest in these funds. Additionally, there is a lot less hassle with dealing with mutual funds than you would have to do if you were just investing in stocks.

Tax deductions can be made under Section 80C of the IT Act up to a maximum of Rs 1.5 lakh per financial year for a variety of investments, and tax-saving mutual funds are one of them. Investing in Equity Linked Savings Scheme (ELSS) can help create tax savings, but it takes up to three years for the fund to double. To date, it has become a popular investment, due to its relatively high rates of return and the ease of withdrawing the fund’s book within three years to spend or reinvest.

Convenience

Investing in mutual funds is a convenient and cost-effective way to diversify your portfolio. It also allows for greater control and flexibility in investment, which can be appealing for those who are new to the investment world.

Professional fund management

Mutual Funds are a type of fund managed by a professional fund manager and backed by a team of researchers. They are designed to manage risk while also generating profits. The fund manager formulates the investment strategy for your account made based on your asset allocation. The team of researchers picks suitable securities as per the objectives.

Low initial investment

Mutual funds make it easier to invest a small sum of money in an investment that has the potential for large returns. When you invest in mutual funds, you are diversifying your investments and spreading the risk of your portfolio. You also have more control over what you’re investing in.

With SIP, you can also reduce the cost of your investment while equipping it with the power of compounding. With an aggressive saving rate, that may be as low as Rs 500 per month, you can build a diversified multi-asset mutual fund portfolio of your own.

Things to Consider as a First Time Investor

There are many different things to consider when it comes to investing. However, the one thing to always keep in mind is that there are a lot of factors that affect your returns, and it’s important to understand exactly what those effects are so you can make educated decisions.

Fix an investment goal

Before investing in a mutual fund, make sure you have an investment goal. You can decide on the price, or time to maturity that you want to invest in based on your individual personal goals. Think about what level of risk you are comfortable with and plan accordingly.

Choose the right fund type

It is important to choose the right type of fund before investing. Mutual funds offer a variety of investment options for your company’s needs. A mutual fund is a product that pools investments from different investors and invests in equity, bonds, or fixed-income assets through a professionally managed portfolio of securities.

As someone who is just getting started with investing, the first thing you don’t know is what kind of fund you are going to invest in. They have to learn about it. Mutual funds come in many different types and all have their unique features. Depending on your needs and goals for the future, you can choose a fund type that might be better suited for your needs.

Shortlist and choose one mutual fund

Many factors come into play when deciding whether or not to invest in mutual funds, including your investment goals and the types of risks you want to take on with your investments. One way to maximize your returns when you first invest is to decide what kinds of investments work best for you, balancing the risk level with the return that you hope for.

You can choose from many different types of mutual funds that make up for different niches. To maximize your returns when you first invest, it is important to decide what kind of investment strategy you want to take on as well as how much risk you want to take before choosing the right investments for you

Investors should try to understand the basics of mutual funds before they choose one. The first step is to make a shortlist of two or three mutual funds, and then eliminate those that don’t meet your requirements. For example, if you are looking for a long-term investment, you shouldn’t invest in short-term funds regardless of their low expense ratio.

Investors must have a multitude of factors to keep in mind when selecting a mutual fund, including the fund manager’s credentials, expense ratio, portfolio components, and assets under management.

Diversify your portfolio

Whether you’re new to investing or a seasoned investor, there are a few things that should be considered as a first-time mutual fund investor. First and foremost, it is important to diversify your portfolio. Diversifying your portfolio can help protect your investments if one investment does poorly. Depending on the investment goals and risk tolerance, investors should make sure they diversify their portfolios. It’s also important to invest in funds that offer different types of assets like stocks, bonds, and cash.

Whether Go for SIPs instead of lump-sum investments?

One major question among investors’ minds when investing their savings is whether lump sum investment in mutual funds or small contributions is the best option. Systematic investment plans are advisable for beginners who are investing in equity instruments. Small recurrent investments can produce effects that are accumulated over a number of years, which will then provide the compounding interest rates.

Investing with systematic investments plans may be phased in slowly if invested in equity instruments that minimize risk according to timing and lower the initial purchase price. The benefits of rupee cost averaging may be realized over time when invested through systematic investment

With a systematic investment plan, investing in the stock market becomes a safer and more profitable venture. Whether you don’t have enough money to put in one time or you want to reduce the fluctuations in your returns, this is an excellent way to begin. You can invest when it’s convenient for you from any location and still be able to average out your purchase price to get higher returns over time. You can visit how much amount should be invested to achieve your goal by sip calculator

Keep KYC documents updated

When you first start investing in mutual funds, you’ll be required to provide proof of your identity and address. This includes documents such as a PAN, passport, driver’s license, or bank statement with where the money is coming from. These documents will often expire after a few years, so you’ll need to keep them updated regularly. We help you there.

You need to keep your KYC documents updated in order, for the mutual fund company to check them and process your application. You should also make sure that you have done this before you start investing because it will take some time.

Open a Net Banking Account

Mutual funds are investment options that can be activated via internet banking on your bank account. Some mutual funds also allow investments to be made through credit cards and cheques, but more often, these are done via net banking for a faster, more straightforward process.

Seek advice from a financial advisor

Before deciding to invest in mutual funds, first-time investors need to consult with a financial advisor. They will be able to help you decide which type of mutual fund is best for you, and also point out any potential risks that come along with this investment. Additionally, the purchase process can be tedious. Multiple goals need to be considered before deciding to use mutual funds which are tailored toward different savings needs.

How an investor can invest in mutual funds in India?

Before investing you must complete your KYC at a KRA (KYC Registration Agency) online by filling out the KYC registration form and uploading the self-attested identity proof such as PAN Card and address proof such as Passport/Driving License/Voter ID and also a passport size photograph. You will also have to complete the IPV (In-Person Verification) by SEBI-approved agencies.

You may choose to invest in mutual funds through a distributor or intermediary by opting for a regular plan. With this investment type, the mutual fund house would be paying the distributor’s commission, not you. If you are interested in investing offline, you can go to the AMC office and fill out an application form of direct plan, providing it with your documents for KYC compliance.

Or you can also invest directly with the mutual fund house through the direct plan. You just have to visit the website of the mutual fund house and fill up your relevant details such as name, email id, mobile number, and bank details.

Conclusion

In today’s ever-changing world, it can be challenging to find good investments. Mutual funds are a great way to start investing in the stock market; not just because they give you exposure, but also because they offer a structured path and opportunities for diversification. The following is a guide designed to help you get started with mutual funds and investing.